Image from https://xkcd.com/2280/: all credits to xkcdOriginal article in Italian here: https://vincenzo.me/bitcoin-il-grande-vaffa-ai-maghi-di-oz/ This is the first article in English in my blog. There’s no better way to inaugurate it than with my thoughts on Bitcoin, especially after the recent “halving”, and compare its 11-year history with the Dollar and Euro. It’s rude to use offensive words as in the title, I know; but I couldn’t really find better terms to summarize the warning scream that Bitcoin is sending to the monetary policy gurus around the world.

Bitcoin

The xkcd comic is packed with meanings, especially in strange Coronavirus times like these.

When I co-founded Conio in mid-January 2015, a Bitcoin was worth € 200. Today, 5 years later, it is worth more than € 8,000. A 40-fold increase.

To be honest though, I care relatively little about the price of Bitcoin. What really ignites my interest me is technological progress, how it can facilitate human life and well-being: in this, unfortunately, Bitcoin has not kept all the promises of 11 years ago as a currency of exchange, also due to technological limits that have been not solved yet.

What is Bitcoin? If I had to describe it to my mother in understandable (though not quite correct) terms, Bitcoin is:

- a digital asset, of which I am the only and sole owner

- a digital asset that I can take with me anywhere in the world (in a smartphone, or a USB drive for example)

- a digital asset that I can transfer to whomever I want, thus changing its ownership

In many ways, Bitcoin is a file that becomes similar to cash, only more manageable and free in its use.

Over the years, Bitcoin has undergone a profound transformation in its use: as an currency of exchange, it is increasingly used and treated as a new investment asset. Something limited in quantity (only 21 Million Bitcoins will ever be created), and in which it is wise to invest in small quantities to diversify one’s portfolio.

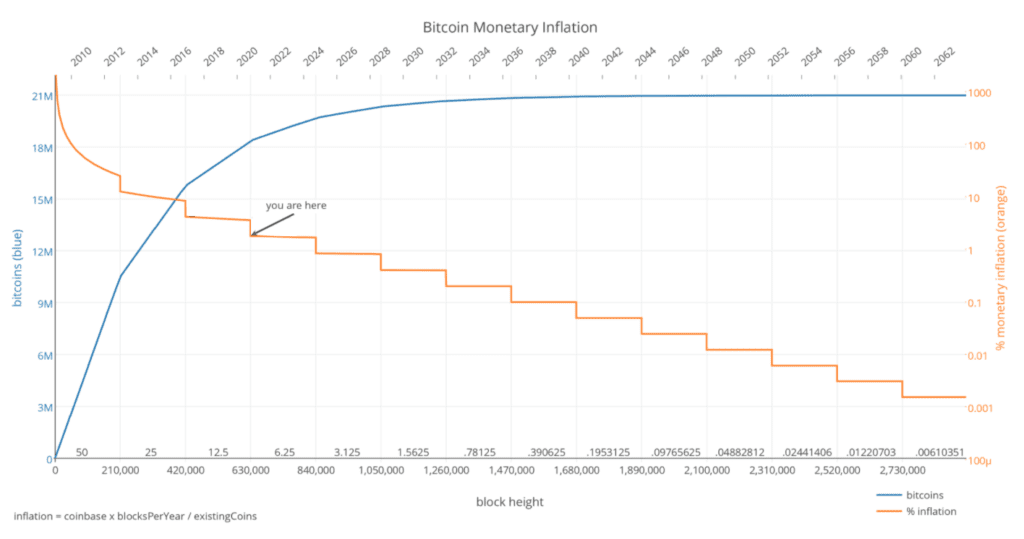

In this sense, Bitcoin is a file that becomes similar to gold, and with an extraction rate (“mining”) mathematically predictable over time from January 3, 2009 (date of birth of Bitcoin) until 2140, the year in which its extraction will run out (i.e., all 21 Million Bitcoins will have been created).

But, use cases and developments aside, the most important thing that Bitcoin has shown in recent years has absolutely been the following one. As in the Wizard of Oz (where an impostor appeared powerful and threatening, using illusion tricks and special effects, while hiding his true identity behind the curtains), Bitcoin made people aware that behind the curtains of captivating and bombastic words of the finance, such as “Bazooka” and “Quantitative Easing“, there are often only people who distort the perception of reality.

Money

What is money? And what gives it value? This is the most disruptive question that Bitcoin raised. We live today in an era of continuous and repetitive devaluations as in the case of the Euro, if not even unlimited devaluations as in the case of the Dollar. Or now even emerging countries are starting to adopt this “strategy”, as The Economist a bit sarcastically says: “Unconventional monetary policy is not just for the rich world“.

But, despite all, money does not go to the people, to the real economy (not imaginary one). Talking about imagination and philosophical artifices, this incredible money supply remains firmly confined to the Plato’s hyperuranion of the usual banks.

I consider myself lucky for having experienced the 80’s and 90’s in Italy: it is fascinating for me to think that in those times it was not custom to use English terms; terms which can be cool but – let’s admit it – at the same time often mask deceptions. Back in those years in Italy the word on the street was “svalutazione” (“devaluation“): an Italian word with a clear meaning to everyone, continuously associated with the Lira currency and described with contempt. But in any case, along with it, “svalutazione” (“devaluation”) brought positive effects for the Italian citizens.

Today, however, we prefer to use more magniloquent phrases in English (“Whatever it takes“) and devaluation is celebrated. Incredible: it was enough to simply give it another name to make a 180-degree turn in its perception. What a contrast to previous decades. Yet today, unlike the 80’s and 90’s, instead of pouring this monetary windfall from the sky onto people, banks and financial institutions have accumulated it to replenish their own accounts.

Instead of doing their job, and therefore lending money; instead of helping workers, the real economy: the money remained up over there. Just as it had been fictitiously generated, money remained confined to a banking fabrication.

And, as if it were not even enough, interests in the bank have now reached negative rates or are about to reach them: that is, customers pay for the “privilege” of leaving money in the bank. And risking that, if the bank bankrupts, customers’ savings disappear with it.

Let’s make a comparison

On May 11 2020 Bitcoin achieved the third “halving” of its history. Arrived on time like a Swiss watch, and everything went smoothly without problems.

It’s a positive thing in terms of value: today, and for the next 4 years, the number of Bitcoins generated every day will be half of those before May 11 2020.

Let’s see it like this. On one side:

- Central Banks of basically all countries of the Earth are multiplying the printing of paper money as if there were no tomorrow; though, letting people reap only marginal economic benefits.

- For illustrative purposes, below is a chart with the history of the US dollar. In just 12 years, from 2008 to 2020, the monetary base of the dollar has increased by 6 times, and today it reaches $ 5 Trillion.

On the other side:

- Bitcoin halves its money creation, also helping people to benefit economically from this decrease (note: in my opinion, it is absolutely wise to invest in Bitcoin amounts from 1% to maximum 5% of one’s savings)

- For illustrative purposes, below is a chart with the history of Bitcoin, from 2009 to 2140. The monetary base of Bitcoin increases at a pre-established periodic rate, and the number of Bitcoins generated is halved every 4 years (“halving”). In the graph I marked the halving that took place on 11 May 2020.

- In short, Bitcoins are generated in increasingly infinitesimal quantities: today there are just over 18 Million Bitcoin in circulation; in 120 years (in 2140) 21 Million will be in circulation. That is, less than 3 Million more in a span of over a century.

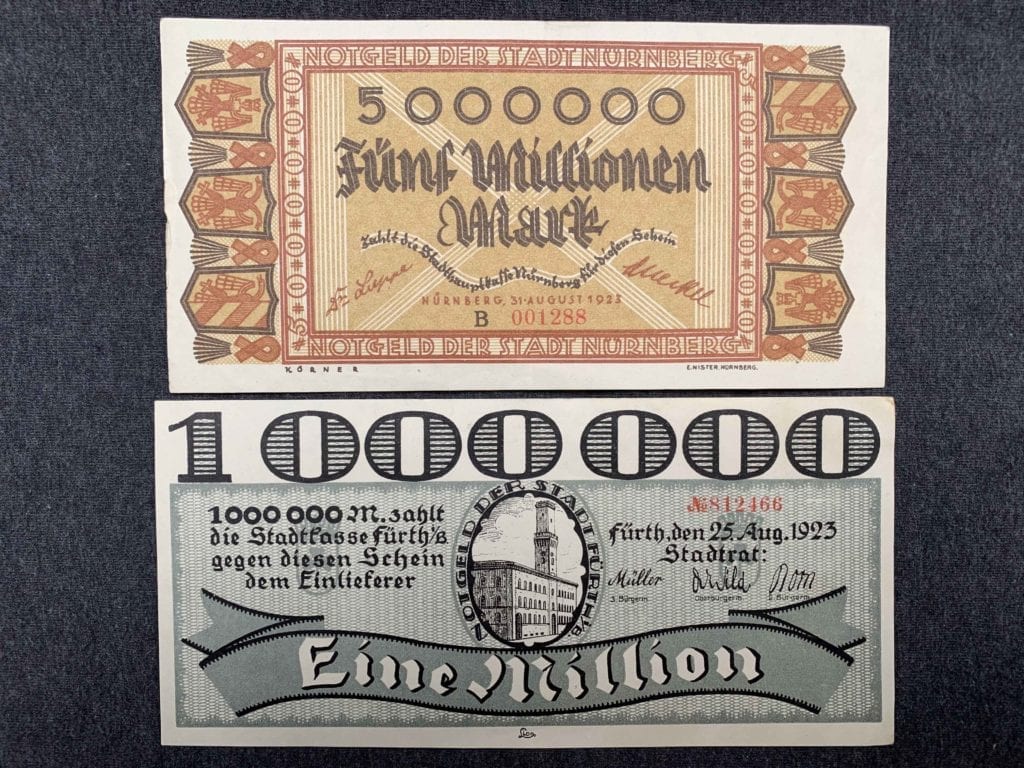

That is, while Euro and Dollar look more and more like the Million / Billion German Marks of the Weimar Republic, printed on one side only:

PapierMarks of the Weimar Republic Bitcoin looks more and more like this:

St. George slaying the dragon: classic image of the British gold Sovereign Which one do you prefer?

In the end, money is nothing but trust. The trust that we all, as a community, give to something: a great collective illusion, useful, but still an illusion. And when that illusion is continually exploited beyond any acceptable limit, you wonder whether it still makes sense to continue to believe in it.

The true strength of Bitcoin

I want to repeat it. Bitcoin is not perfect, especially in daily use. On the other hand, people definitely do not use Sovereigns or a gold coins in everyday life.

- Bitcoin has not solved its scalability problems. It only allows about 10 transactions per second on its network: nothing, if compared to the tens of thousands of transactions per second of Visa / Mastercard.

- Bitcoin is by no means anonymous, despite the popular belief. The anonymous digital coins are others, for example Monero and Grin.

- Bitcoin is not programmable. For example, unlike Ethereum, with Bitcoin you cannot practically create “tokens” representative of digital goods such as stock market shares, nor set it to automatically give aids such as the Universal Basic Income to entitled people.

However, to say it like Schopenhauer, Bitcoin was the first to tear the “Veil of Maya” and see beyond the illusion of traditional money. It has opened up a new world of technology, and over the 11 years since its inception it has done one thing very well: increase in value. It did so thanks both to its economic fundamentals and thanks to the devaluation of traditional currencies.

In other words, Bitcoin is a great “F**k You”, as in Italy the once anti-system 5-Star Movement would have said: a “F**k You” to a financial system that makes less and less sense, and a “F**k You” to the pundits who continue to praise economic theories of no help to ordinary people.

The Future

Three years ago, in 2017, I wrote this article in the Formiche magazine, still very valid (by the way, this article of mine was followed immediately by an article written by Paolo Savona, economist and ex Italian Minister).

(Sorry it’s only in Italian). There in the article I mentioned that we would have seen the digitalization of national currencies. Nowadays, this is accelerating, and almost every Central Bank in the world is working on this. Some examples:

- “China aims to launch the world’s first official digital currency” headlined The Economist on April 23, 2020. Among other things, it is evident that this move by the Chinese government aims to contend the US dollar for the global dominance of currency in international trade.

- Central Bank of France launched a call for applications to experiment a Central Bank Digital Currency (CBDC). Deadline was May 15, 2020.

- European Central Bank has repeatedly confirmed their interest in the sector. In December 2019 with its President, Christine Lagarde. And in an even more powerful way on May 11, 2020, with Yves Mersch (member of the Executive Board of the ECB), who suggests, quite rightly I say, the creation of a decentralized and anonymous national digital currency.

But there’s more to it. There have even been the first signs of a global digital currency with Libra: the currency as initially proposed by Facebook, and whose projects then changed a month ago. But it is now crystal clear, even to the most stubborn skeptics, that digital coins are going to have an increasingly dominant role in our future.

These are digital coins of ordinary everyday use, different in several aspects from Bitcoin, but from which – as happens in every great technological and scientific disruption – they took inspiration. And there is still a lot to build and uncharted roads to travel, with all the opportunities and perils of a new frontier.

These years in Conio have been and keep being exciting. I have known and continue to know the best of Italy, the best of people who seriously innovate heads down: deeds, not empty words. Thanks to them, at Conio we managed not only to keep up with the evolution across the world, but even to blaze a trail with the very first bank integration in the world.

We live in unique times: difficult, but also of profound transformation. Change in itself is not a bad thing, especially if citizens, and not the usual players, benefit from it. And I hope I can continue to help my Country and this space: to bring useful change, and not be overwhelmed by it.

Leave a Comment